cap and trade system vs carbon tax

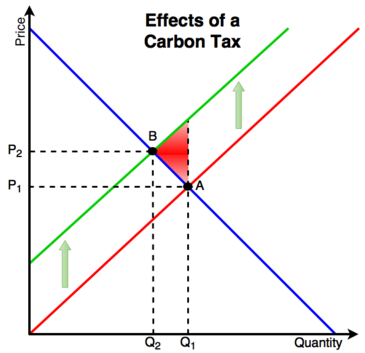

A carbon tax directly establishes a price on greenhouse gas emissionsso companies are charged a dollar amount for every ton of emissions they producewhereas a. Reducing greenhouse gas emissions is a necessity to combat climate change.

Difference Between Carbon Tax And Emissions Trading Scheme Difference Between

For firm A the 3 tax is less than the 4 cost to reduce so A pays the tax and does not reduce emissions.

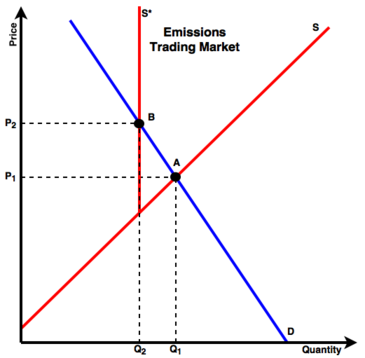

. While a carbon tax sets the price of CO2 emissions and allows the market to determine the amount of reduced emissions a cap-and-trade system sets the quantity of emissions allowed which can then be used to estimate the decline in the rise of global temperatures. Its the EA Madden Pro Bowl 21. Cap-and-Trade systems limit the amount of carbon dioxide that gets emitted but gives little control to the price.

Government sets a tax of 3 per ton of emissions. Indeed in stable world with perfect information cap and trade would be exactly equivalent to a. -Like the Cap-and-Trade system a Carbon Tax can be structured such that 100 percent of the money is returned directly to the people who are taxed-A Carbon Tax discourages carbon emissions but cannot limit them to quantifiable annual levels-A Carbon Tax is based almost exclusively around the nation-state level.

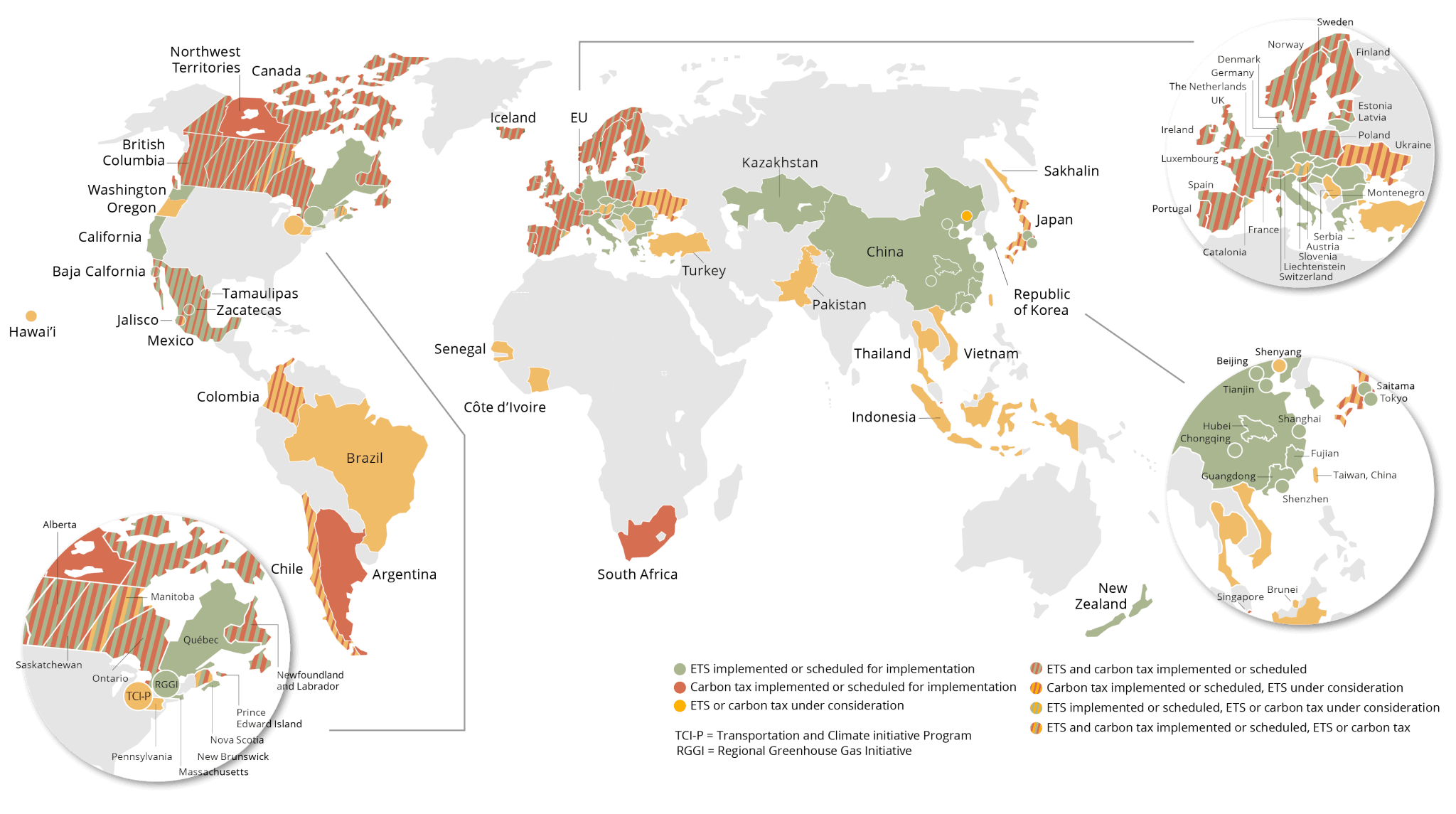

The EU implemented its cap-and-trade system in 2005 to reduce their carbon emissions from 10000 industrial emitters in the Union David Suzuki Foundation 2020. 19338 August 2013 JEL No. When these companies purchase carbon credits and can cap their product without giving issues to Mother Earth.

11 Price and Quantity. Carbon Tax vs. It seems inevitable that some day Congress will pass legislation meant to cut greenhouse-gas emissions.

E-WULAAS Electronic Water Use Licence Application Authorisation System - Posted on November 15 2021 By Admin 947 Stand To Win Up To R5 000 Cash With Standard Bank Competition 2021 - Posted on November 13 2021 By Admin About 2021 Madden Draft Tfg. Cap and Trade. By contrast a cap-and-trade system sets a.

Cap Trade vs. Carbon Taxes Which system can impact CO2 emissions the most. Carbon taxes makes emitting carbon dioxide more expensive.

Due to its vision it can really lessen the trade effects of. The main greenhouse gas produced by human actions is carbon dioxide or CO2 Overview of Greenhouse Gases. TFG 2021 Draft Class Gems.

No matter how much gets emitted a carbon tax makes the emission the same. Theory and practice Robert N. So while a perfect cap-and-tax system is better than either cap-and-trade or carbon tax alone a.

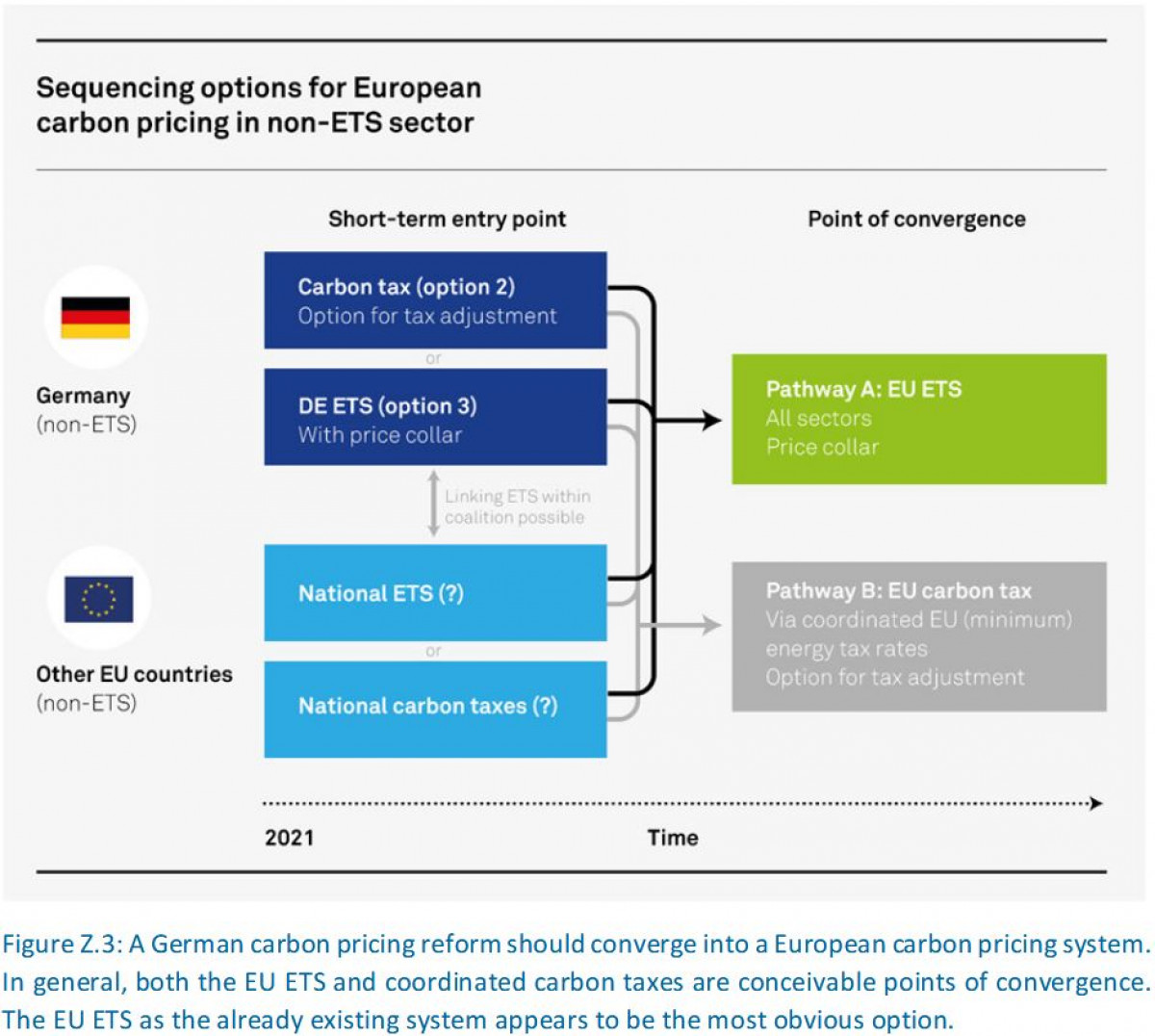

The cap and trade system is thus functionally similar to a tax on carbon. This can be implemented either through a carbon tax known as a price instrument or a cap-and-trade scheme a so-called quantity instrument. If the European Unions Emission Trading Scheme ETS accomplishes.

Carbon Tax vs. A cap-and-trade system and a carbon tax are both market-based policy instruments that create incentives to reduce carbon emissions. Bitmex Longs vs Shorts Bitcoin shorts vs longs data is provided by Bitfinex.

H23Q50Q54 ABSTRACT We examine the relative attractions of a carbon tax a pure cap-and-trade system and a hybrid option a cap-and-trade system with a price ceiling andor price floor. A Critical Review Lawrence H. The system of cap and trade is to hold back the massive quantity of pollutants that often let loose by most energy companies.

Carbon taxes vs. Stavins Harvard Kennedy School abstract There is widespread agreement among economists and a diverse set of other policy analysts that at least in the long run an economy-wide carbon-pricing system will be an essential. It fixes the total quantity of emissions and allows the price of energy and energy.

April 9 2007 413 pm ET. A carbon tax while not easy to implement across borders would be significantly simpler than a global cap-and-trade system. A cap-and-trade system is a quantity-based instrument.

The cap aspect is where a government sets an emission cap and issues a. The tax rate could also be designed to achieve a given stabilization target. Under a cap-and-trade system reduced economic growth would lower allowance prices.

For firm B the 3 tax is more than the 2 cost to reduce so B pays no tax and eliminates emissions. A carbon tax imposes a tax on each unit of greenhouse gas emissions and gives firms and households depending on the scope an incentive to reduce pollution whenever doing so would cost less than. 5 hours agoTrey Lance - 967 2.

A carbon tax and cap-and-trade are opposite sides of the same coin. A carbon tax sets the price of carbon dioxide emissions and allows the market to determine the quantity of emission reductions. The best you can hope for is a good system or maybe a mediocre system.

The basic idea of a cap-and-trade system is to control carbon emissions by creating a regulated marketplace in which polluters can buy and sell emissions while adhering to aggregate caps. Goulder and Andrew Schein NBER Working Paper No. 14 hours agoSo even if youre buying and selling other cryptocurrencies such as Ethereum Ripple and Litecoin you have to start by depositing Bitcoin.

On the other hand political economy forces strongly point to less severe tar - gets if carbon taxes are used rather than cap-and-trade which is why envi-ronmental NGOs are opposed to the tax approach. This can be implemented either through a carbon tax known as a price instrument or a cap-and-trade scheme a so-called quantity instrument. A good cap-and-trade w.

1 Effects of Emissions Trading and a Carbon Tax. Decreases climate advantages harmful effects. A cap-and-trade system through provi - sion for banking borrowing and pos - sibly a cost-containment mechanism.

Under a tax government action to lower the amount of the tax not market forces would be required to reduce the carbon price seen by firms. Changes in economic activity impact a firms behavior under either system. Jan 09 2022 BitMEX is a cryptocurrency exchange that lets you trade crypto with leverage up to 100x.

In times of economic expansion the. Carbon taxes and cap-and-trade are ways to price carbon but they both have some key differences.

The World Urgently Needs To Expand Its Use Of Carbon Prices Carbon Greenhouse Gases Paris Agreement

Economist S View Carbon Taxes Vs Cap And Trade

Putting A Price On Emissions What Are The Prospects For Carbon Pricing In Germany Clean Energy Wire

The World Urgently Needs To Expand Its Use Of Carbon Prices The Economist

Emission Reduction Panacea Or Recipe For Trade War The Eu S Carbon Border Tax Debate Clean Energy Wire

Carbon Tax Carbon Pricing 15 Minute Guide Ecochain

Cap And Trade Basics Center For Climate And Energy Solutions

Archive World Bank Group President Jim Yong Kim On Twitter Cap And Trade Climate Reality Sustainability News

Carbon Tax Carbon Pricing 15 Minute Guide Ecochain

How An Eu Carbon Border Tax Could Jolt World Trade Bcg

Carbon Tax Vs Emissions Trading Energy Education

Germany S Carbon Pricing System For Transport And Buildings Clean Energy Wire

Cap And Trade An Overview Sciencedirect Topics

Carbon Border Taxes Are Defensible But Bring Great Risks The Economist

Where Carbon Is Taxed Overview

Carbon Tax Carbon Pricing 15 Minute Guide Ecochain

Carbon Trading Prices Worldwide By Select Country 2021 Statista